Last week I saw an article on the news that indicated that Small Businesses perception of the ease of access to finance is close to historically low levels.

A question that I get asked frequently is whether banks are freely lending money since the end of the Royal Commission. My short answer to this is “no they have not”. My longer answer is that I actually do not expect any significant change in the short to medium term.

To explain why I think that there is not going to be rapid change. When the Royal Commission looked into lending practices, the banks were criticised for not taking into account the individual circumstances of their borrowers. Amongst other things, it was alleged that the banks relied too heavily on benchmarks such as the household living expenses measure, therefore they lent money in an irresponsible manner. Faced with allegations of this nature, it is no wonder that banks are scrutinising loan applications more closely and asking more questions. It is for this reason that I do not expect to see the banks significantly alter their behaviour any time soon.

I talk to a lot of business owners and am also in regular discussions with bankers. It is fair to say that there is a desire on behalf of business owners to access finance and there is also a desire by bankers to provide finance. Banks make money by lending money, so there is an absolute requirement for them to continue to lend. The question for me then becomes how do businesses ‘persuade’ the banks that they are a good risk?

There are a few things that can be done (in no particular order):

1. Up to date financial reporting:

This is not a particularly new concept however, the more up to date the financial information that you can provide to the bank, the easier it is for them to make a better decision. Even if you can provide management reports (from Xero/ MYOB etc) the bank will be able to make a better decision.

2. Understand (and be able to communicate) your group structure:

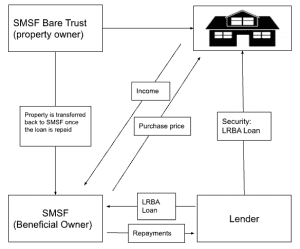

Accountants are very good at putting in place complex corporate structures to protect assets and (legally) reduce tax. It is important that you are able to show a diagram of your group structure and explain how the entities relate to each other and how the money flows. As a rule, banks will ‘look through’ complex structures and will take security over all entities. If the bank does not understand your structure, it is unlikely that they will be prepared to lend to it (or it will create time delays).

3. Be clear about the benefits and risks of the transaction that you are wanting the bank to finance:

If you are purchasing a new asset, be clear about how it will benefit the business, either through additional income, increased efficiency or other benefit. On the flip side, it also pays to communicate any risks that the benefits will not eventuate and what, if anything, can be done to reduce those risks.

Even if you are simply wanting to refinance your existing loans to change the finance structure, be clear of the benefits that you are seeking. As an example, if you are wanting to change to an interest only structure, outline what you are intending to use the additional cash flow for. A move to interest only means that you are potentially not gaining equity, outline why the alternative use of cash flow is a better use of the funds.

4. Have good projections:

Banks are expecting their borrowers to become increasingly more sophisticated. As part of this increased sophistication, they expect to see quality projections. Increasingly, we are seeing banks wanting more than the traditional excel spreadsheet ‘profit and loss’ forecasts. They are increasingly wanting three-way forecasts along with detailed assumptions.

5. Pay yourself:

Your projections should also demonstrate that you can still pay yourself (as the business owner) after all finance costs. You also need to show that you are able to pay yourself enough to live on. Increasingly, as part of their increased information gathering, the banks are wanting to understand the financial position of the directors and shareholders of the SME business. They not only want to see that the directors and shareholders are being paid, they are wanting to see that they are being paid enough.

6. Be aware that a traditional bank may not be the best solution:

Banks have a defined risk appetite and there are numerous instances where a non-bank can be a far better option than a traditional bank. An application to a bank (that is subsequently declined) can be an extraordinarily time consuming and deflating experience.

Summary and Conclusion:

Going back to the opening paragraph, it is actually our experience that finance is absolutely available for well-considered applications from borrowers who are well prepared and can articulate their case. There is no doubt that the banks will be seeking more information in order to make a decision and this is going to be part of the ‘new normal’ for the foreseeable future.

Rob

Source: Alan Kohler (ABC News). Sensis.

#BankingRoyalCommission #SMEFinance #SmallBusiness #Businessloans